AutoComplete OCR

Increasing the data validation score up to 90%, saving around 10+ hours

Zero-effort auto-protection is offered by Autocomplete, a US-based startup company that provides a unique user experience.

An OCR solution for data extraction, verification, and validation, minimizing errors in data management.

Summary

Autocomplete is a US-based startup company that enables its users to choose their own automobile insurance plans. Combining artificial intelligence with strategic partnerships they have enabled a user experience that provides zero-effort auto-protection. Folio3 developed a state-of-the-art computer vision-based AI solution that processed the data from multiple insurance providers and input the extracted data into autocomplete application.

Customer

Founded in 2009, Autocomplete offers its users the chance to select their own auto insurance plans. With the combination of artificial intelligence and strategic partnerships, they have created an auto-protection experience that requires no effort from the user. AutoComplete's 3 co-founders are all repeat founders who have raised capital from top-tier VCs, built billion-dollar companies, and exited successfully to Allstate, Groupon and Ford.

-

Team composition

7 members

-

Client name

Autocomplete

-

Expertise used

Optical Character Recognition (OCR), PostgreSQL & Django functionality

-

Duration

5 months

-

Services provided

AI Model Development, Automated AI Solution, Data Validation, and Segregation

-

Country

US

-

Industry

Insurance

Solution

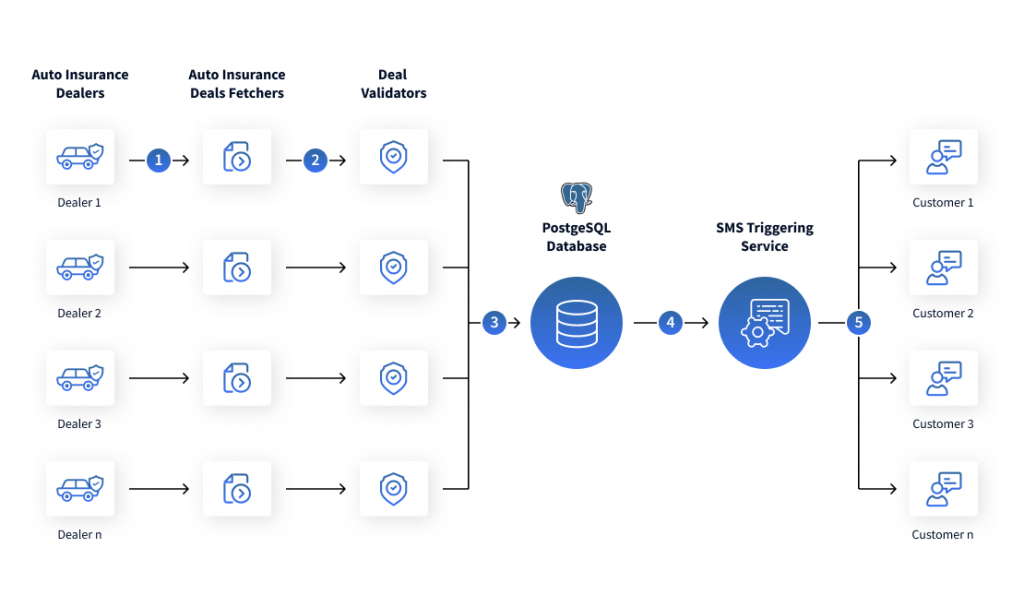

Folio3 built an OCR solution for Autocomplete and developed a middleware app that will receive the data from multiple insurance providers and dump that data into autocomplete application through OCR AI technology. There were approximately 7-9 insurance providers' data that needed to be extracted and integrated

The data relevant to partner dealerships were collected and stored in it a PostgreSQL database for further, manual analysis. A system-agnostic database schema was built to identify data quality issues in DealerTrack. Folio3 maintained an audit trail of all of the updates to records via standard PostgreSQL & Django functionality, to allow querying for historical information of all records.

The extracted data was verified for validation and stored in the database for safety and segregation.

Result

The platform developed and integrated by Folio3, allowed Autocomplete to automate the data extraction and validation process, saving them about 10+ hours of manual labor and increasing the data validation score up to 90%.

Get a Free Consultation about our solution

Tech Stack