How mortgages are leveraging machine learning technologies? What is the future of mortgage companies after artificial intelligence and machine learning? Are mortgage companies using these advanced technologies? It’s needless to say that people have questions, and since these technologies are still relatively new, the companies are having a hard time understanding the implementation.

To begin with, mortgages are leveraging AI technology and machine learning algorithms for delivering smart solutions. It’s evident that mortgages are essential for financial institutions and consumers alike. On the other hand, the lending processes of mortgages are complicated and there are various manual interventions involved.

The mortgage lending processes can be time-consuming, tedious, and frustrating for both parties (yes, the lenders struggle as well). However, the availability of machine learning and artificial intelligence are streamlining the workflows. With the integration of predictive analytics, human intervention will be reduced and the decision-making will be automated. Let’s see more about machine learning’s leveraging in the mortgage industry!

Improved Application Verification

Ai Companies has the capacity to help with verification which is beneficial for borrowers as well as lenders. To illustrate, the lenders can access historical data for training the predictive models. This helps with an accurate estimation of income levels, respective to potential factors. Then, the information can be compared to the stated income levels for confirming the validation and reasonability.

The comparison helps check the accuracy. For the most part, the automated assessment improves expense verification and income verification. In addition, it helps outline the need for manual review in case of high-risk situations.

Better Document Validation

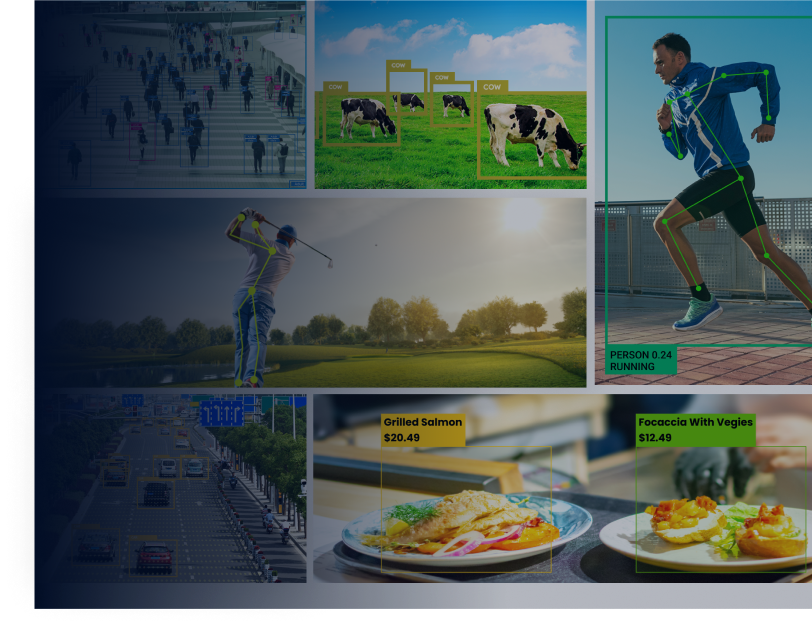

When it comes down to mortgage lending, it can be document-intensive and a plethora of documents are required for executing the loans. The lenders have to validate the information for consistency, completeness, accuracy, and correctness. In these cases, machine learning models can be optimized to validate the information.

This is because the machine learning / computer vision models can outline the text within the document and compare the information. This comparison helps ensure that application forms are filled out accurately and have no errors. In addition, it allows the loan officers to focus on manual tasks that cannot be automated.

Methodology

The methodology associated with machine learning allows the automatic classification of mortgage-focused documents. These documents include bank statements, payslips, valuation documents, legal documents, correspondence, and income assessments. It will ensure that information is readily available for smart decision-making while reducing costs and risks.

Generally, these risks are associated with manual documentation but machine learning techniques can improve time and funds utilization.

The Essential Features of Trained & Well-Built Machine Learning Models

When it comes down to the mortgage industry, there are various features that ensure the proper building of machine learning models. These features include the following;

Model deployment

this is about the GUI-based interface for the deployment of models through REST APIs. It also helps maintain the metadata

Model management

the users can manage the model versions across different platforms to ensure convenient administration and transparency

Model performance

the users can monitor the model performance of the models and access automated notifications. These notifications are suitable for model recalibration whenever the performance notches down

Explainability

the ability to keep an eye on Explainability helps determine the rationale of every decision made by the model

Workspace embedding

the machine learning models can be integrated with the CRM systems, payment systems, and transactional systems

Role-based access

machine learning provides high-end role-based access for model management

At this point, it’s pretty evident that machine learning is likely to have enhanced applications within the mortgage industry. With the implementation of machine learning technologies, mortgage underwriters and lenders will be profitable, efficient, and deliver improved customer experience.

Is Machine Learning Helping Mortgage Providers With Digital Transformation?

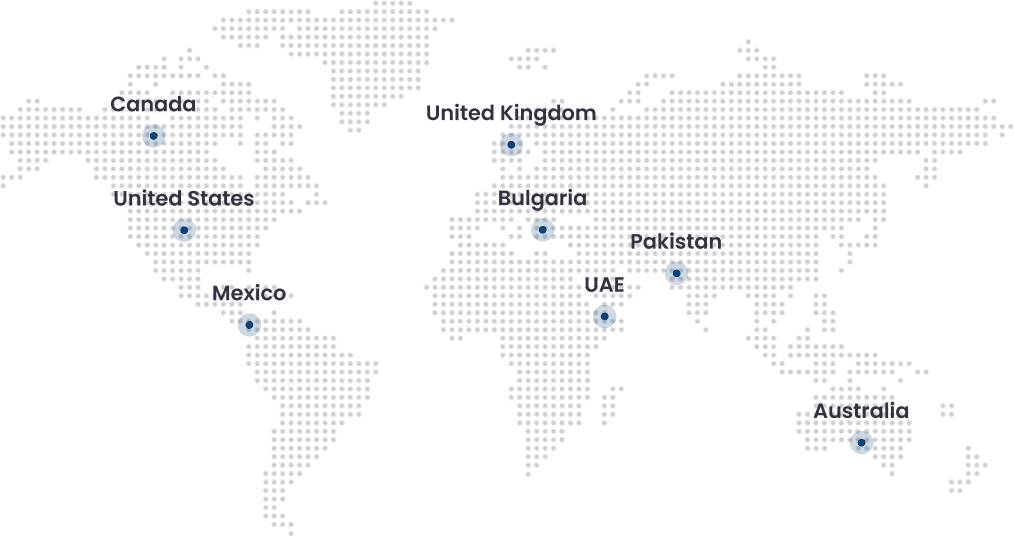

To begin with, yes, machine learning is surely helping mortgage providers with digital transformation and we will talk about how in this section. Ranging from process automation to predictive analytics and advanced data modeling, there are various factors involved in improving mortgage businesses. The companies can claim digital transformation and make changes in data centers.

For instance, Carrington Mortgage Holdings is offering lending and mortgage services and they have launched digital document automation, process automation, and data modeling in mainstream production. They are deploying machine learning for advancement inefficiency and improves data modeling. In addition, it offers quality compliance and improvement.

Currently, mortgage companies are adopting machine learning to deliver paperless and contactless environments. It’s safe to say that machine learning will help buyers find a home quickly and deliver the financing options that meet their needs. That being said, it will result in a simplified customer experience.

The integration of predictive modeling and machine learning can help enhance the mortgage lenders’ ability to offer the right services and products at the right time. Machine learning delivers constant improvement in the accuracy and efficiency of data models and processes that weren’t possible before machine learning. It’s essential to outline the data sets and market conditions are rapidly changing.

At this point, machine learning is helping with these unique standards. For instance, machine learning is empowering mortgage companies to reach out to customers with personalized help that focuses on their mortgage-related issues. Secondly, the integration of machine learning with robotic process automation will leverage the benefits of real-time output processing.

Machine learning is improving product processing which improves the customer experience. Various mortgage companies are using the combination of machine learning and robotics process automation in lending, loading servicing, and titling.

What about the Future Of the Mortgage Industry With Machine Learning?

When we talk about the current deployment of machine learning in the mortgage industry, it’s important to determine the future. 2008 is known to be the watershed year for the mortgage industry. This is because there was a financial recession due to risky lending practices. However, the risk-averse policies and servicer consent orders were adopted by mortgage companies to avoid catastrophic issues.

With various industrial development, the mortgage industry has gained its momentum. It’s safe to say that the industry is safe for tech-oriented innovations without compromising on economic efficiency. This economic recovery has enhanced the efficiency of loans. On the contrary, new technologies like machine learning and artificial intelligence have breathed life into this industry.

In this section, we are sharing various factors about how the mortgage industry will be changed with machine learning. Let’s dive in deeper, shall we?

Racial Discrepancies

According to studies, there have been gender and race bias in the mortgage industry for decades now. According to a study conducted by Woodstock Institute in Chicago states that women are 14.5% low likely to get loans as compared to males. In addition, there are discrepancies in the allocation of loans to white people and black people (black people won’t get loans even if the loan application is qualified).

These unethical and illegal biases are existential in lending and employees of mortgage companies don’t even identify them as biases anymore. It’s safe to say that these biases have become the decision-making psyche. At this point, it’s needless to say that there are hundreds and thousands of black people, Hispanics, and Asians who would be great customers if they were allowed the loans.

Truth be told, it has become an exploitation for mortgage companies. However, with the implementation of machine learning, these biases are highly likely to be removed because decision-making is done by machines. As a result, mortgage companies will have new revenue streams.

Turned-Downed Customers

The utilization of machine learning can exploit the inability of customers to get mortgage loans only because they were turned down once. Generally, applications are turned down because of insufficient equity, low credit scores, and higher loan-to-value ratios. However, these factors can be improved by applicants with better financial status.

Truth be told, manual change monitoring is challenging for the applicants. On the contrary, machine learning technologies can be used for monitoring changes in financial status. Machine learning can monitor the macroeconomic measures, such as property prices, interest rates, and determine the impact of these measures on applicants (the ones who were declined previously).

Loan Application Reviewing

With machine learning, the reviewing of loan applications will be streamlined and applications can be checked for completeness. It will ensure that information entered in the application is correct and consistent. This is a feasible technology that helps read the document and identify the images. Also, we are certain that these technologies will be mainstreamed.

Sales & Customer Services

With machine learning, mortgage companies can focus on customer service and sales calls and deliver feedback to the managers and customer service representatives. The real advantage is that machine learning will help identify the business opportunities in the calls since it can transcribe the conversations, highlight the missed opportunities, and share them with managers.

Customer Retention Information

Sure, machine learning can identify the missed and/or hidden mortgage opportunities but it can also predict the chances of customer retention. The information can be utilized by mortgage companies to take advanced steps for preventing the missed opportunities. Also, machine learning can deliver loan modification programs for high-risk customers.