Research has shown that 80-85% of identity frauds are synthetic thefts. This is quite alarming and is a good reason to take synthetic identity fraud seriously. The scourge has become even more prominent with the growing advances in the digital world as fraudsters are daily devising more crooked means to defraud their victims.

To guard against these threats, you should be familiar with not only how synthetic identity fraud works but how to read the warning signs. Here, you will learn what this menace is all about, the warning signs and how you can protect yourself from it.

What Is Synthetic Identity Fraud?

Synthetic identity fraud occurs when a fictitious identity is created using either valid or fabricated data like a person’s name, date of birth, address, and social security number. This information is typically obtained by fraudsters through dark web marketplaces and data breaches.

Data of unsuspecting victims could also be stolen from unsecured websites by these defrauders. This is why it is important to only visit secure websites. To protect yourself, find out how to differentiate secure websites from unsecured ones.

According to Auriemma Group, a consulting firm in the Consumer Payments and Lending industry, in 2016, $6 billion was lost annually to synthetic identity fraud. This shows this type of fraud is dangerous and should not be toyed with.

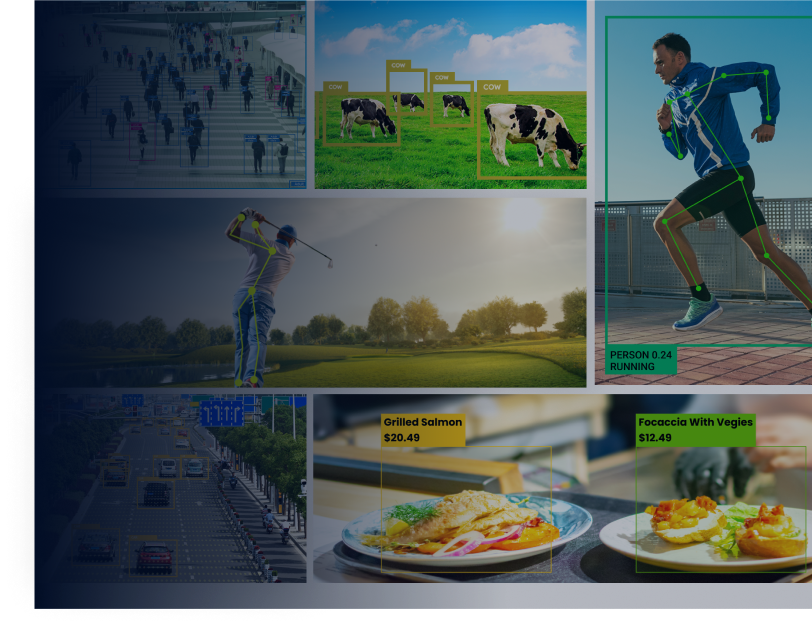

There is hope for the reduction of synthetic identity fraud. This is because computer vision and artificial intelligence technology help significantly in fraud detection. With the advancement in the industry, AI can detect fraudulent transactions.

How It Works and Why You Should Find Out More About It

To know the warning signs of synthetic identity fraud, you need to know how the fraud takes place. Not only that, you also need to increase your awareness and find out more about prevent synthetic ID fraud. When you take these steps, you fortify yourself against being a victim of these defrauders.

As early said, these con artists mix fake and real data to create a new identity that they then use to commit crimes. Here is how it works. A fraudster, for example, can generate a new identity by combining a stolen social security number with another person’s name, address, and mobile number. After that, the thief can use the identity to apply for credit cards, mobile devices, and commit other crimes.

9 Warning Signs of Synthetic Identity Fraud

Here are 9 warning signs of synthetic identity fraud you should look out for in no particular order.

Sign 1: Strange charges on your credit card

Unfamiliar charges on your credit card are a sign that your account has been compromised. When you see a charge that you did not authorize, take it as a major red flag. Be sure to scrutinize your transactions properly and look for minor charges instead of only the large ones.

It’s easy to limit one’s attention to major charges. However, scammers frequently begin with a small test purchase to check that your card account is active. Detecting these smaller purchases can warn you before they make a bigger purchase. This is a good way to detect credit card fraud.

If you notice any unauthorized transactions, get in touch with your credit card provider straight away. Deny the transactions and obtain a fresh card.

Sign 2: Unusual charges on your bank statement

Read every transaction on your monthly financial statement immediately after you receive it. Check for anything out of the ordinary, regardless of how minor it looks. To increase security, inspect your bank account operations before the final statement comes at each month’s end.

If you observe any unusual purchases, contact your bank right away. To safeguard your financial assets, you may need to open a fresh bank account.

Sign 3: Credit denial

If you apply for a new credit line and you are denied even though you are qualified, then it could be an indication that a third party is misusing your credit. In the event of fraud, check your credit report. If you recognize any suspicious transactions, promptly inform the vendors and your bank.

Many identity theft victims have a decreasing credit score but are unaware of it until it is already late. If you’ve been refused a new credit line, this is a major red flag that must be addressed quickly.

Sign 4: Requests to verify strange purchases

Pay attention when you get an email, a call or a text message trying to verify an unknown purchase, it could be a case of identity fraud. Take this kind of message from your credit card issuer or bank seriously. Any unapproved transaction attempts should be investigated and reported.

However, keep in mind that such calls are a popular phishing scam. To authenticate or flag the purchase, all you need to say is a simple “yes” or “no.” A scammer is attempting to steal your identity if a strange caller contacts you and requests further details, like your name, password or account number. In addition, getting unrequested text messages of 2FA verification codes from internet platforms to which you have subscribed is another red flag you should watch out for.

Sign 5: Unauthorized sign-up for a new credit card

One of the red flags you should watch out for to know if your identity has been stolen to commit fraud is an unauthorized sign-up for a new credit card. Therefore, if you discover that a new line of credit has been opened in your name and you did not sign up for it, then you may be at risk of identity theft. When this happens, you are advised to instantly freeze your credit.

A new credit card could be announced to you via a message in the mail, through an email or a telephone call from a new lending institution. Even so, thieves often link the card with another address, and there is a high possibility that you will not be notified.

That is why you should inspect your credit report regularly. AnnualCreditReport.com, which collects data from the major credit bureaus — Equifax, Experian, and TransUnion — offers a free credit report.

Sign 6: Credit report showing hard inquiries

There are two types of inquiries made by businesses to a credit reporting agency; soft inquiries and hard inquiries. Soft inquiries are made by your bank and companies that provide pre-approval. They are almost always harmless and frequently occur without your knowledge. However, hard inquiries are not the same.

Before any hard inquiries can take place, they must be approved. If you notice any unusual hard inquiries on your credit file, it’s a sign that another person is trying to apply for credit in your name. You should immediately contact your financial institutions and make a report. Nowadays, many financial institutions also have fraud detection software and tools that can prevent synthetic identity fraud.

Sign 7: Decrease in credit score

A drop in your credit score should raise an alarm that something might be amiss. It could mean that someone has impersonated you and used your name to open other credit cards. These cards can be used to apply for loans or commit other frauds. The result of this is that your credit score nose-dives.

If you notice a drop in your credit score, look into it right away. Examine your credit history and look for any abrupt changes in your credit score, particularly if your recent activities cannot justify such a change.

Sign 8: Mail theft

If important bills or statements are missing in your mail, then it could be an indication that synthetic identity fraudsters have played a fast one on you. Through the use of a change-of-address scam, scam artists can redirect your bills or statements. They could also steal sensitive documents from your mailbox to obtain your private info and even carry out deed fraud.

If your financial statements or medical bills are missing, contact your bank, insurance company and credit card provider. It is advisable that you also double-check that the companies you do business with have your actual address on record.

Sign 9: Lost or stolen ID

When you lose your wallet, the first thing you’re likely to worry about is your credit card. However, a stolen driver’s license or a lost ID may be significantly costlier in the long run. If you end up finding your wallet and realize your driver’s license has been stolen, you may be a victim of identity theft. Should this happen to you, make sure you report to the appropriate law enforcement agencies.

To prevent your identity from being stolen in this manner, never carry your social security card in your purse or wallet and avoid carrying too many credit cards. You could also get an app that can track all of your personal information, including your social security number, driver’s license, passport number, and other information.

Be on alert for signs of synthetic identity fraud

In this digital era, synthetic identity fraud is one major threat that should not be underrated. To protect yourself from falling victim to it, you need to be familiar with the warning signs. These signs include but are not limited to the following; strange charges on your credit card, unusual charges on your bank statement, credit denial and requests to verify strange purchases.

Other indicators include unauthorized sign-up for a new credit card, credit report showing hard inquiries, decrease in credit score, mail theft and lost or stolen ID. Being on the lookout for these signs will help fortify you against the risk of synthetic identity fraud.